Tax Brackets 2024 Single Filers – If you fall into a lower tax bracket this year, you might see an increase in your take-home pay. Courtney Johnston is a senior editor leading the CNET Money team. Passionate about financial literacy . There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. .

Tax Brackets 2024 Single Filers

Source : www.forbes.com

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

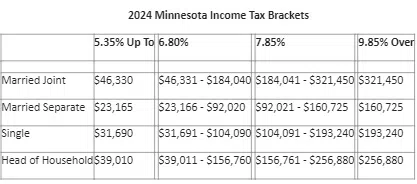

Minnesota Department of Revenue Announces 2024 Tax Brackets | KNSI

Source : knsiradio.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

2024 Tax Code Changes: Everything You Need To Know | RGWM Insights

Source : rgwealth.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

2024 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Source : taxfoundation.org

2023 2024 Tax Brackets & Federal Income Tax Rates – Forbes Advisor

Source : www.forbes.com

IRS Announces 2024 Income Tax Brackets. Where Do You Fall

Source : drydenwire.com

Federal Tax Income Brackets For 2023 And 2024

Source : thecollegeinvestor.com

Tax Brackets 2024 Single Filers Your First Look At 2024 Tax Rates: Projected Brackets, Standard : The IRS reviews all income tax brackets annually, making adjustments as necessary to balance for inflation. For the 2024 tax year, tax rates range from 10% at the low end to a top rate of 37%. These . But only the money above that threshold flows into the next tax bracket; the rest of your money is still taxed at the same rate. Here’s an example of how it works: Suppose you’re earning $45,000 and .