Child Tax Credit 2024 Table Instructions – For the 2024 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700. This means eligible taxpayers could receive an additional $100 . While you might already know about the 2023 child tax credit and other family tax breaks for the current year, here is what you can expect for the 2024 tax year (for income tax returns normally .

Child Tax Credit 2024 Table Instructions

Source : www.irs.gov

A free IRS tax filing software is launching in 2024 — do you

Source : mashable.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

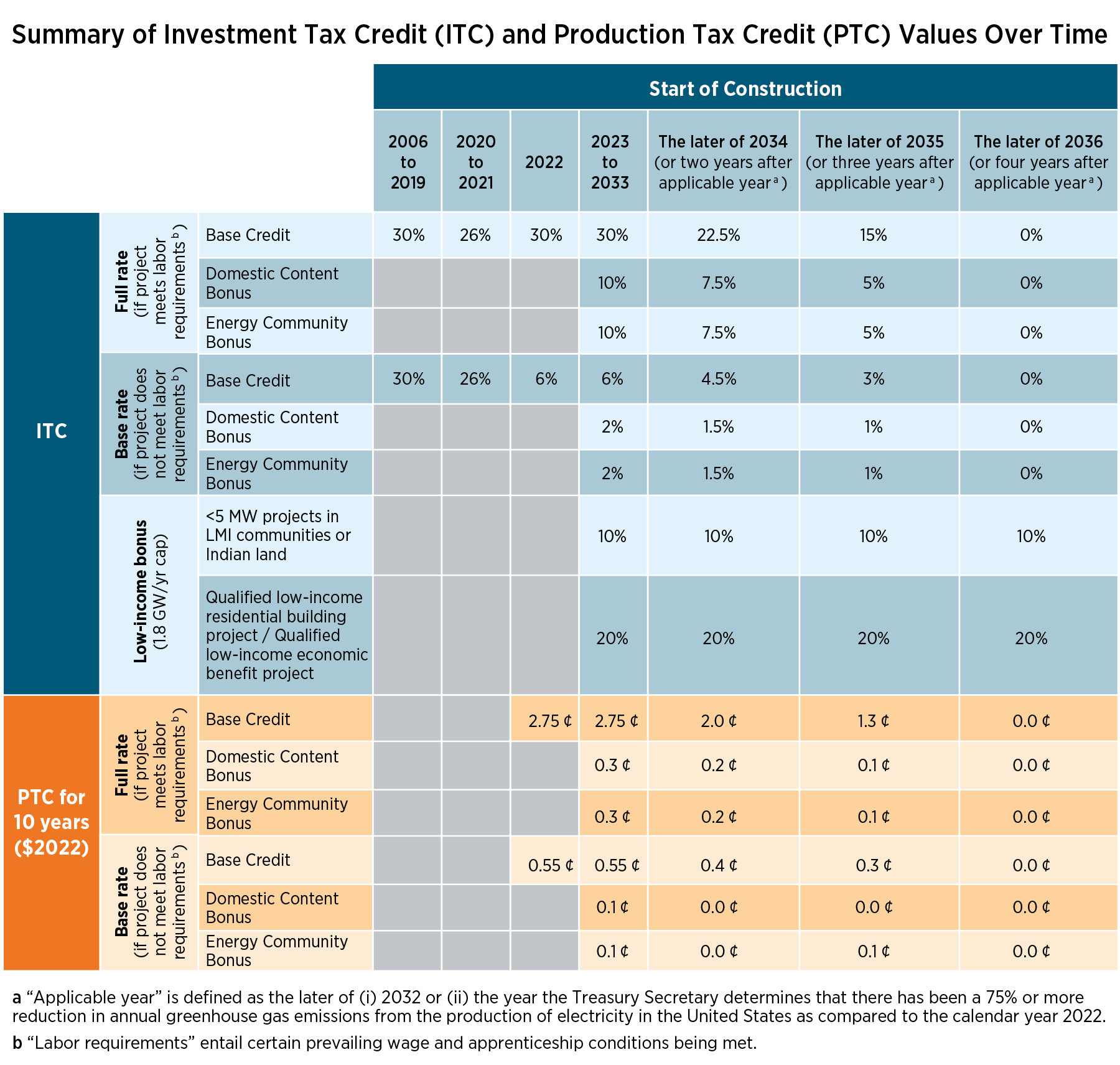

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

Poverty Action on X: “At Poverty Action, we’ve got our finger on

Source : twitter.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Britepaths | Fairfax VA | Facebook

Source : www.facebook.com

Health Insurance Marketplace Calculator | KFF

Source : www.kff.org

1040 (2023) | Internal Revenue Service

Source : www.irs.gov

Federal Income Tax

Source : www.investopedia.com

Child Tax Credit 2024 Table Instructions 1040 (2023) | Internal Revenue Service: Gypsy Rose, from convincing boyfriend to kill her mother to becoming a TikTok star The Child credit can be claimed on the federal tax return (Form 1040 or 1040-SR) and must be filed by April . Lawmakers in Congress are closing in on a tax deal that would satisfy both parties’ interests and partially revive the expanded Child Tax Credit the start of the 2024 tax season on 29 .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)

:max_bytes(150000):strip_icc()/Screenshot2023-12-14101210-777d825ead72468587c3d238dfe0fe1c.png)